The Caribbean Development Bank has entered into an arrangement with the Government of Grenada that will result in start-up businesses and students getting access to financing.

Health Minister Nickolas Steele made the disclosure during Tuesday’s post-cabinet briefing. He said that almost half of this credit line of US$10 million will be allocated to entrepreneurs.

“Of that amount, EC$13.5 million is for business loan start-ups and existing businesses. Inclusive of this is, EC$1.35 million is specifically earmarked for renewable energy and energy efficiency initiatives,” said Steele, who is also a member of Government Economic Investment Committee. Loans can range from EC$8,000 to $945,000, at an interest rate of 8.5% interest per annum. Repayment period will be 12 years inclusive of a 3-year grace period.

Steele said that EC$9.45 million will go towards general student loans. “Terms: 8% per annum, 12 years repayment of interest only during the period of study,” said Steele, who explained that EC$1.35 million will be allocated for special student loans, for those who are described as vulnerable students. Students in that category will pay an interest rate of 5 % during studies, and 7% upon completion.

The credit line will also provide for home ownership, with EC$2.7 million going toward home mortgages for lower middle-income citizens. A maximum of EC$180,000 will be loaned to a homeowner who has a collective salary of approximately $4,000.

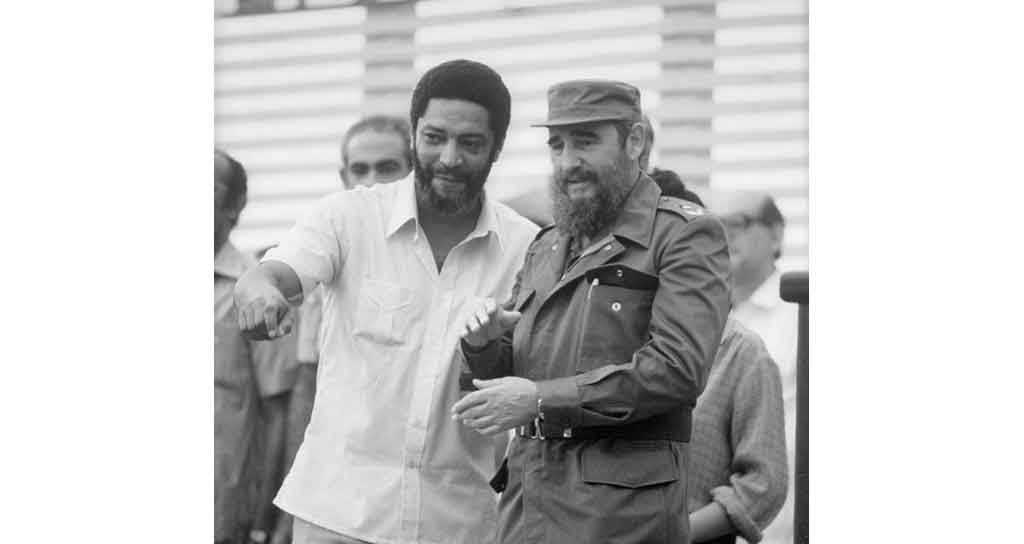

The credit line will be accessed through the Grenada Development Bank. The decision by CDB to disseminate the money follows a meeting of the CDB Board of Governance, which was held 20–21 May in Barbados. Prime Minister Dr Keith Mitchell was among the regional leaders who attended the meeting.