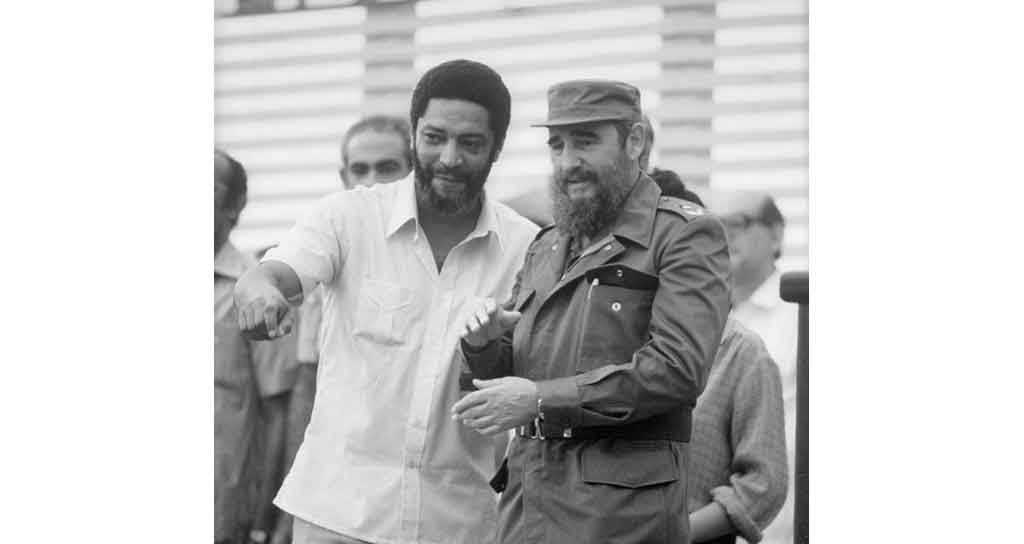

by Linda Straker

Reduced personal income taxes and the cost of cooking gas are among the fiscal relief measures announced by Finance Minister Dr Keith Mitchell when he presented the 2017 budget to the Lower House of Parliament on Friday.

These measures, he explained, are directly linked to his Government’s fundamental philosophy of putting more disposable income in the hands of the people, especially workers, who have made sacrifices since the implementation of the Structural Adjustment Programme.

“Without the decisive response by this Government and the sacrifices of our people to confront the fiscal challenges, the situation today would be unthinkable,” said Dr Mitchell, as he listed the fiscal measures that will affect both individual and corporate citizens.

Other relief measures are a Tax Registration Amnesty, a Tax Filing Amnesty ,and the removal of all Income Tax on pension income.

The Tax Registration Amnesty will operate during the period January to March 2017, and it will facilitate the registration of taxpayers with the Inland Revenue Department without the imposition of the penalty for failure to register.

He explained that the Tax Filing Amnesty for Annual Stamp Tax will cover the period 2013 to 2015 without the imposition of the filing penalty. “The period of this filing amnesty will be from June to August 2017,” he told the packed Trade Centre.

“Further, we have heard the request from the business community for a relief on the rate of the Annual Stamp Tax. We will, therefore, reduce the rate from 0.75 to 0.7%. This reduction will take effect for the tax period 2018,” he assured.

Cooking gas will be reduced from EC$42 to $40 as of January 2017, while Personal Income Tax which was applied as of 2014 at a scale of 15% to all persons earning EC$36,000 annually or $3,000 monthly, will reduce to 10% from January 2017.

The Finance Minister said that the timing of these adjustments is to ensure that Government meets its obligations under the Structural Adjustment Programme and the Fiscal Responsibility law, as well as making the requisite arrangement at the Inland Revenue Department.

Public Workers in the coming days are scheduled to receive two instalments of increments, for 2014 and January–June 2016, and by the first quarter of 2017 will receive a one-off payment for the sacrifice made during the SAP programme which is scheduled to conclude December 2016.

In the area of economic performance, the Prime Minister announced that 2016 was performed exceedingly better than expected. The data reflected a 3.5% economic growth for 2016, and for 2017 the economy is projected to grow in real terms by at least 3.0%.

The 2017 Estimates of Expenditure provides a total expenditure of EC$1,100,578,144. The largest allocation is debt servicing, receiving EC$433.4 million or 39.4% of the total expenditure.