by Curlan Campbell, NOW Grenada

- 20% economic contraction expected across sub-region

- ECCU customers to benefit from a 6-month moratorium on repayment of loans

- Interest payment will not be waived

A 20% economic contraction is expected across the sub-region as the coronavirus Covid-19 pandemic forces shut down of economies across the Eastern Caribbean Currency Union (ECCU).

Governor of the Eastern Caribbean Central Bank (ECCB), Timothy Antoine, made the statement while speaking on the topic “Financial Prudence in light of the Economic Trajectory” during a Covid-19 briefing, over the last weekend.

The latest numbers, Antoine said, indicate that the contraction is likely to be within the vicinity of between 10 to 20% noting that the contraction in the tourism sector is largely responsible. “Clearly one of the biggest drivers of that is the tourism sector, which, as you know, is now shut. It is our lead sector, foreign exchange, jobs, government revenue, our tourism sector has ground to a halt,” said the ECCB Governor.

Antoine stated that the stark reality is that it is unclear as to how soon will the tourism sector rebound since the economic damage of this pandemic will most likely outlast the pandemic. “In the absence of a vaccine, we are likely to have a protracted recovery process, so that 12 to 18 months do not appear, in my estimation, to be unreasonable at this stage,” he said.

Another grave reality highlighted by the ECCB Governor is the sharp rise in unemployment in countries in the sub-region which are seeing revenues plummeting, by as much as 50%. He also pointed to the fact that remittances which have played a significant role in the regional economy have declined significantly as a result of the pandemic. “In fact, we may see a phenomenon we observed after the global financial crisis, when we saw reverse remittances, that is to say, people in our currency union were sending money to people in the United States and the UK.”

With regards to foreign direct investments (FDI), Antoine said that in the short term, there will be a decline, and that may also include the Citizenship by Investment Programme (CBI) through which foreign investors are granted citizenship of countries, in return for making a substantial investment in their socio-economic development.

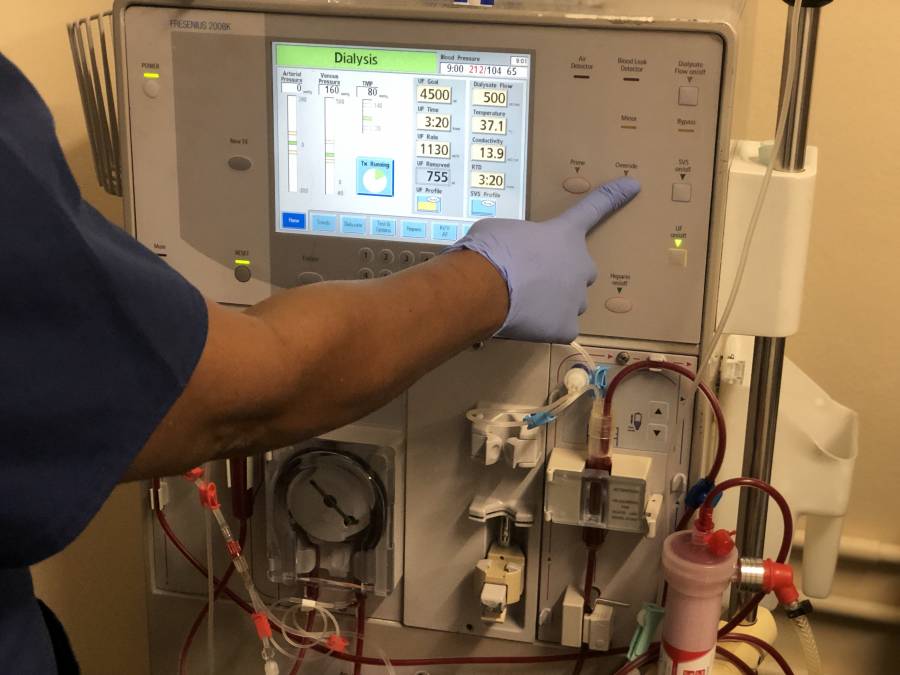

It is in this regard that the Eastern Caribbean Central Bank has taken the decision to allow customers in the ECCU to benefit from a 6-month moratorium on the repayment of loans during the pandemic which has caused the loss of income and job security for most.

Antoine urges commercial banks to explain loan deferrals to their customers, as interest payment will not be waived.

“We have asked all banks to explain to customers what a loan deferral/moratorium means. What it means essentially is that you can get relief on principal and interest which means cash flow relief for the period of the deferral whether that is 3 months or 6 months. What it does not mean is that interest is waived, because interest is not waived and that is going to be the situation in all financial institutions,” he said.

Answering questions from reporters over the weekend, Antoine explained exactly what the loan deferral/moratorium would mean for customers going forward. “Effectively your loan is going to get larger by the amount of the interest accrued and the length of the loan is going to be longer because you may need a few additional months to repay. If you take a loan deferral for 3 months, your loan is likely to last 3 months longer and if you take it for 6 months it will likely last for 6 months longer. So we have asked that all banks properly explain what does that mean so that people evaluate their options.”

Antoine acknowledged that the IT systems in some commercial banks may not allow for this new approach for the repayment of loans for customers who are prepared to pay interest but want principal relief.

“Part of our challenge is that many of our banks have certain IT systems which make it perhaps a little challenging for them to do one or the other, so many of them will say that do you want interest on principle or you don’t. We have said work with the customer be flexible, manually make the changes if you have too to give your customer the best options,” he said.

Antione also took the opportunity to explain why there was no relief on the interest payment. “I want to remind you that banks have your deposits and my deposits and they are continuing to pay interest on those deposits and by the way, the banks do not own the deposits but owe the deposits and they have to be paid. So, they have to pay their staff, they have to pay their security, they have to pay technology so it is not possible in this period where banks are collecting less while still making certain payments and extending credit to some customers to keep them going, to expect them to waive the interest and if they were to do that then they will put your deposits at risk,” he said.

In addition to the deferral of loan repayments, a waiver of late fees and charges will be applicable to eligible customers, during this period according to the Eastern Caribbean Central Bank (ECCB). Members of the ECCU includes Antigua and Barbuda, Dominica, Grenada, St Lucia, St Vincent and the Grenadines, St Kitts-Nevis, Montserrat and Anguilla.

Gov. well said and quite articulate as usual! Your work is highly noticed. The Caribbean needs more decisive leaders like yourself. God bless our region.

Governor, where is the innovation?

You told us the problem. Where is the solutions???

Your clearly have the bankers back covered. Who is covering the consumers back.

What are the consequences to the consumers. How many individuals are going to go bankrupt. What are you suggesting to soften their blows and allow them to start again??

When will we see a stimulus for growth or are you not able to put one together??

Same old Singapore Jamaica comparison. How long have the uwi been peddling this silliness.